Ultimate Resource to Car Insurance in Chicago IL

Understanding Car Insurance Requirements in Chicago IL

In Chicago, Illinois, having car insurance coverage is actually not simply an option yet a legal requirement. All drivers need to hold a lowest volume of obligation insurance coverage to monetarily secure themselves and others in the celebration of an incident. The state of Illinois requireds that drivers have to possess liability insurance coverage with a minimum of $25,000 for physical personal injury each, $50,000 for bodily injury every collision, and also $20,000 for home harm.

In addition, drivers in Chicago need to likewise bring uninsured driver insurance coverage to safeguard themselves in the event that they are included in a collision with a driver who carries out certainly not have insurance coverage. This protection assists purchase health care expenditures and damages brought on by an underinsured or without insurance driver. It is actually vital to know these insurance requirements to ensure conformity along with the regulation and to have ample economic defense just in case of a mishap.

Elements that Impact Car Insurance Policy Prices in Chicago IL

The area of Chicago, IL, is known for its own congested roads and high variety of crashes, which can directly affect car insurance costs in the region. One of the crucial variables that influence car insurance policy costs in Chicago is actually the driver's grow older and steering record. Younger and also less seasoned drivers often tend to pay higher costs compared to much older, a lot more experienced drivers along with a tidy driving background.

Also, the kind of vehicle being actually guaranteed additionally plays a notable job in identifying car insurance coverage rates in Chicago. Luxury automobiles and also sports vehicles typically possess greater insurance policy fees because of their much higher price to fix or even substitute. On the various other palm, more dependable and also budget friendly vehicles normally have reduced insurance coverage prices. Various other elements that may influence car insurance policy rates in Chicago feature the driver's credit history, the site where the vehicle is stationed overnight, and the amount of coverage and also deductibles selected for the policy.

Various Sorts Of Car Insurance Coverage Coverage Available in Chicago IL

When it pertains to car insurance protection in Chicago, IL, it is essential to recognize the different options offered to guard on your own and your vehicle. Liability insurance is a compulsory criteria in Illinois, which deals with the costs of accidents or property damages that you may result in to others in an accident. Additionally, uninsured motorist protection can easily assist deal with expenditures if you are actually entailed in an incident along with a driver Affordable car insurance Back of the Yards Chicago IL who doesn't have insurance.

Detailed insurance policy is actually another sort of protection that protects your vehicle coming from non-collision occurrences like fraud, hooliganism, or even natural calamities. Crash protection, however, helps pay out for repair services to your vehicle in the event of a crash with another vehicle or item. Personal accident protection (PIP) can easily cover health care costs for you as well as your travelers just in case of a crash, no matter that was at negligence. Recognizing these various kinds of car insurance protection possibilities can easily aid you make an educated choice when opting for a policy that ideal fits your necessities in Chicago, IL.

Tips for Discovering the greatest Car Insurance Coverage in Chicago IL

When searching for the ideal car insurance coverage in Chicago, it's vital to begin by determining your private requirements and budget plan. Look at the level of protection you demand, whether it be simple obligation insurance coverage or even more detailed choices like crash and also detailed protection. Knowing your driving practices as well as the value of your vehicle can easily help guide you in the direction of the best suited plan.

Next off, make the effort to contrast quotes coming from various insurance companies in Chicago. Costs may differ dramatically in between business, thus acquiring numerous quotes will definitely enable you to locate the very best protection at the very most inexpensive price. Be actually certain to find out regarding any sort of price cuts you may be actually qualified for, including secure driver discount rates or bundling multiple policies. Looking into client assessments as well as the economic stability of prospective insurance carriers can easily likewise give important idea in to their track record and reliability.

Matching Up Car Insurance Quotes in Chicago IL

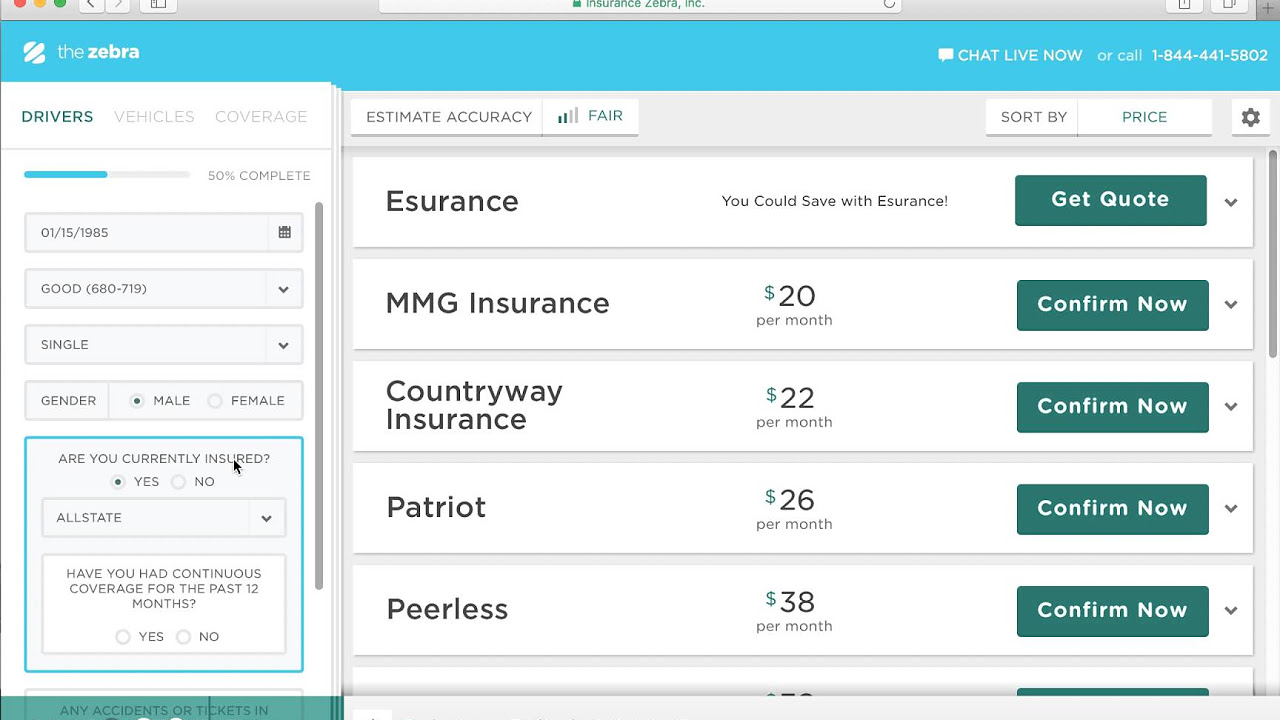

When it concerns reviewing car insurance policy prices quote in Chicago IL, it's crucial to compile a number of quotes from different insurance firms to ensure you are getting the most effective coverage at the absolute most competitive price. Each insurance provider possesses its own requirements for calculating rates, thus obtaining several quotes are going to permit you to bring in an informed choice based upon your particular requirements and also budget. In addition, make sure to evaluate the coverage choices given in each quote, as the most affordable alternative may not always supply the necessary security in case of a crash.

Reviewing car insurance quotes can be a time-consuming procedure, but making the effort to look around may potentially save you a notable quantity of funds in the end. Consider reaching out to local insurance coverage representatives or even making use of on the web evaluation devices to improve the method. Remember to inquire questions concerning any rebates that may be actually on call to you, such as those for secure driving files, packing plans, or vehicle security features. Through obtaining and also reviewing a number of quotes, you can easily be actually certain that you are choosing the greatest car insurance policy for your certain necessities in Chicago IL.

Actions to Take After a Car Accident in Chicago IL

Quickly after a car mishap in Chicago, it's essential to inspect for accidents and also ensure every person's security. Call 911 for clinical assistance as well as turn up the accident to law enforcement if accidents are actually present. Exchange connect with and also insurance policy relevant information along with the other driver entailed. Take images of the accident scene, including any type of loss to vehicles and also concerning disorders, for insurance policy functions. See claims could be useful, thus if there are actually bystanders, attempt to get their call information.

As soon as the immediate actions are looked after, it is actually necessary to inform your insurer concerning the mishap asap. Your insurance coverage supplier will certainly guide you by means of the insurance claims method and detail the called for information. Maintain all documents connected to the collision, including health care bills, fixing quotes, as well as communication with the insurance provider. It is actually essential to accept your insurer and follow their instructions to assist in a hassle-free cases procedure.

Common Car Insurance Oversights to Stay Away From in Chicago IL

When it happens to car insurance policy in Chicago is failing to assess your plan frequently, one common error to avoid. It is vital to reassess your insurance coverage needs and also make certain you have adequate security as your situations modify. Breakdown to perform so could possibly leave you underinsured or purchasing coverage you no longer necessity. One more mistake to prevent is actually certainly not contrasting quotes from different insurance companies. Shopping around for the greatest costs can spare you funds and also guarantee you're receiving the absolute most affordable package available.

Also, overlooking the relevance of comprehending your plan information can be actually a pricey error. It is actually important to understand what is covered, what is actually omitted, and also what your economic tasks are in the event of a case. Not being fully updated may cause unexpected out-of-pocket expenses or refuted insurance claims. Ignoring to take benefit of rebates or even packing options can result in overlooked discounts. A lot of insurance policy firms supply price cuts for variables including secure driving reports, numerous policies, and anti-theft devices, thus be sure to look into all prospective ways to lower your premiums.

How to Lower Your Car Insurance Policy Fee in Chicago IL

When aiming to reduce your car insurance superior in Chicago, there are actually numerous methods you can easily take into consideration. One helpful way is to examine your insurance coverage levels as well as readjust them correctly. Through choosing for higher deductibles or even decreasing protection on more mature vehicles, you might have the ability to lessen your superior prices. Additionally, preserving a well-maintained driving report as well as staying clear of incidents can aid illustrate to insurance coverage suppliers that you are a liable driver, likely causing lesser rates.

Another means to reduce your car insurance policy superior is actually to seek information regarding any type of readily available discounts. Many insurance providers use price cuts for aspects such as bundling plans, possessing an excellent credit history, or even completing a defensive driving training program. By looking into these price cut possibilities and contrasting quotes from a number of suppliers, you can possibly protect an even more cost effective fee for your car insurance coverage in Chicago.

The Value of Examining Your Car Insurance Policy Plan Frequently in Chicago IL

On a regular basis reviewing your car insurance plan in Chicago, Illinois is critical to make sure that you have enough protection for your needs. Lifestyle conditions can transform, and it is vital to upgrade your plan as needed. Through assessing your policy consistently, you can bring in any kind of essential corrections to demonstrate modifications in your steering routines, vehicle, or even residing circumstance.

On top of that, examining your car insurance coverage in Chicago may additionally assist you identify any potential rebates or even discounts that you may be actually eligible for. Insurer frequently supply a variety of markdowns for aspects like safe driving routines, completing a protective driving program, or bundling numerous plans. Through remaining educated concerning these chances, you may potentially lower your premiums and also spare loan on your car insurance policy coverage.

Assets for Car Insurance Coverage Details as well as Support in Chicago IL

When it pertains to finding details and assistance concerning car insurance in Chicago, IL, there are actually many essential sources offered to individuals. The Illinois Department of Insurance is actually an important resource for comprehending state-specific insurance rules and also individual legal rights. They supply manuals and components that can easily assist buyers get through the difficulties of car insurance plan and also coverage alternatives. Also, the division can provide info on exactly how to file criticisms or even issues with insurance provider if needed.

Local insurance agencies and also brokers in Chicago are another vital source for people trying to look into different car insurance coverage options. These specialists possess business expertise and also can supply personalized assistance modified to every person's demands and also finances. Through seeking advice from with a neighborhood agent, citizens can get knowledge right into the very best insurance coverage companies in the region, contrast quotes, as well as choose a policy that suits their certain demands.

Featured Auto Insurance Agency

Insurance Navy Brokers

1801 W 47th St, Chicago, IL 60609